Autoserve Ltd

Very friendly and helpful

Very friendly and helpful. Thanks so much for your help

Great experience

Great experience - fast and efficient service and help from Charlotte.

Great service from Jackie

Great service from Jackie

Very friendly and helpful. Thanks so much for your help

Great experience - fast and efficient service and help from Charlotte.

Great service from Jackie

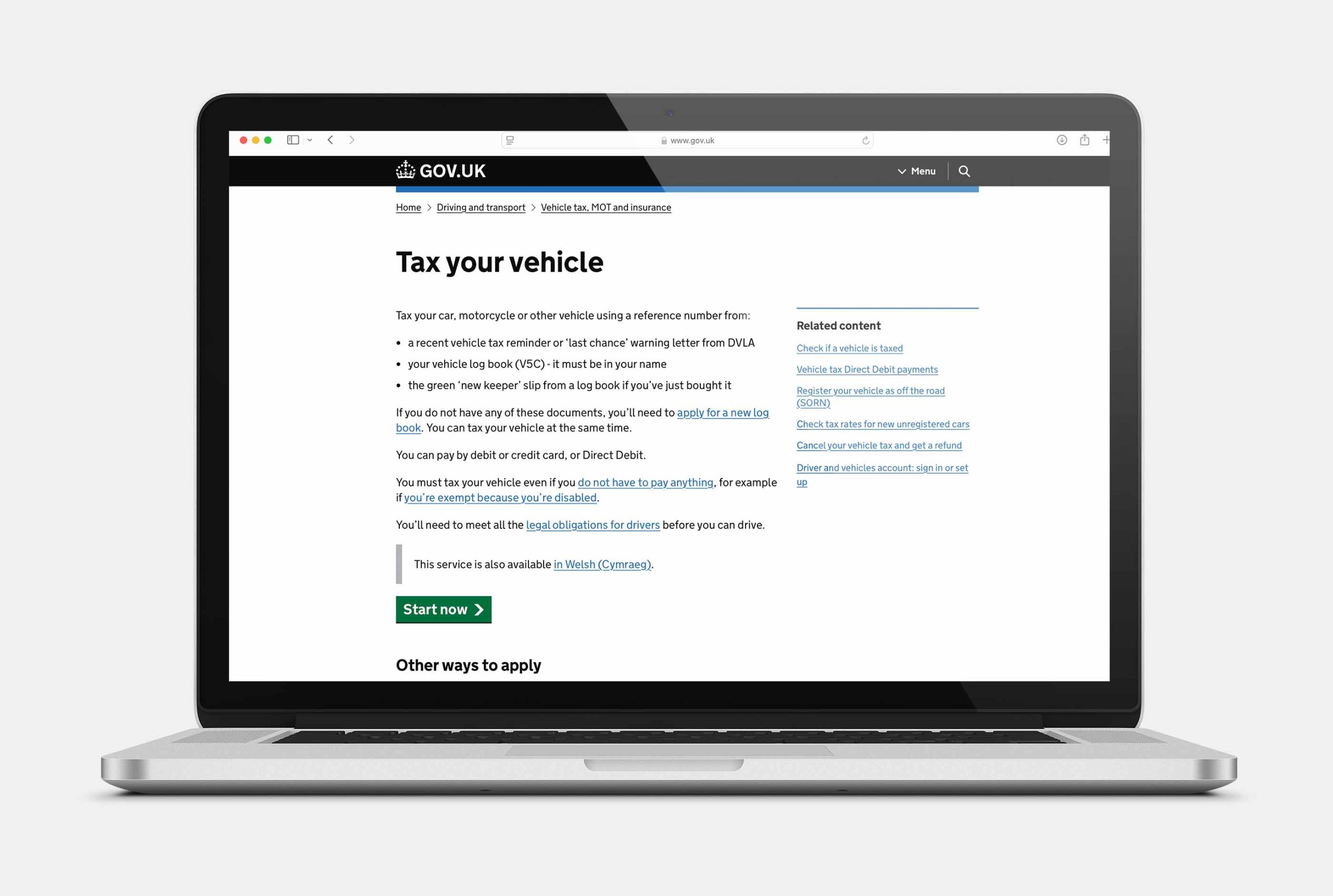

If you’ve noticed a jump in your car tax bill this year, you’re not alone. The annual increase in Vehicle Excise Duty (VED), commonly known as car tax, has taken many UK motorists by surprise. But what’s behind the change — and how much more could you be paying?

Why Has Car Tax Gone Up?

Each year, the government adjusts VED rates in line with inflation. As part of the Spring Budget, car tax rates typically rise in April to reflect the Retail Price Index (RPI). This affects most drivers, especially those with newer or higher-emission vehicles. The aim? To encourage cleaner driving and help the UK meet its environmental targets.

Who’s Most Affected?

The increase impacts drivers differently depending on the type of vehicle they own:

Real-World Impact

For the average petrol or diesel driver, the increase might mean an extra £10–£30 a year. But for higher-emission vehicles or those in the first-year tax band, the jump can be significantly more.

If you run a business with multiple vehicles, even small increases across the board can add up fast — putting pressure on already-tight budgets.

What Can You Do?

Here are a few tips for staying ahead of the rising costs:

Final Thoughts

While the car tax increase may seem small on paper, it’s yet another cost to consider in a time of rising fuel, insurance, and maintenance prices. Whether you’re a personal driver or a business owner, staying informed — and exploring smarter ways to manage your vehicle expenses — can help take the sting out of tax time.